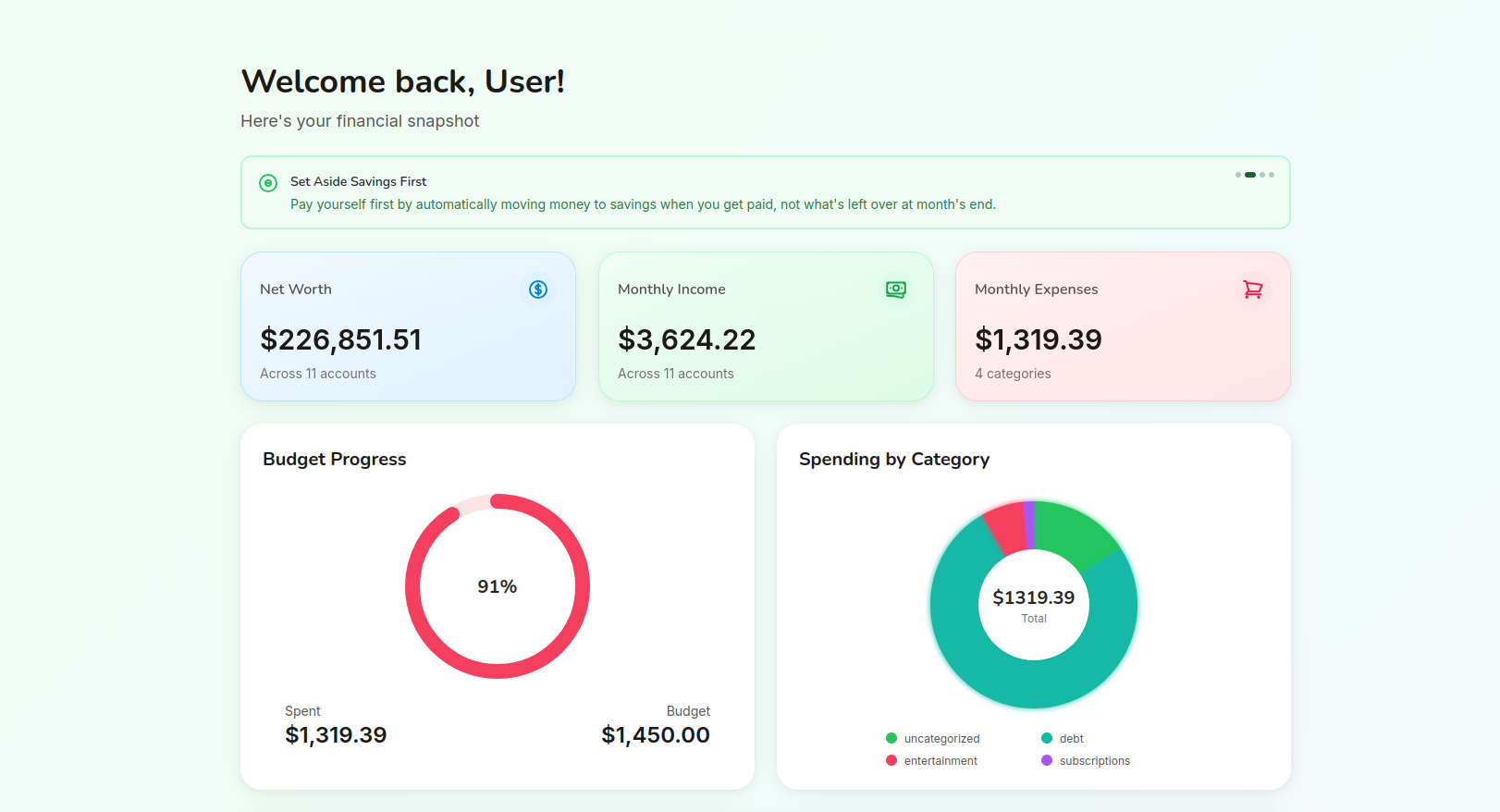

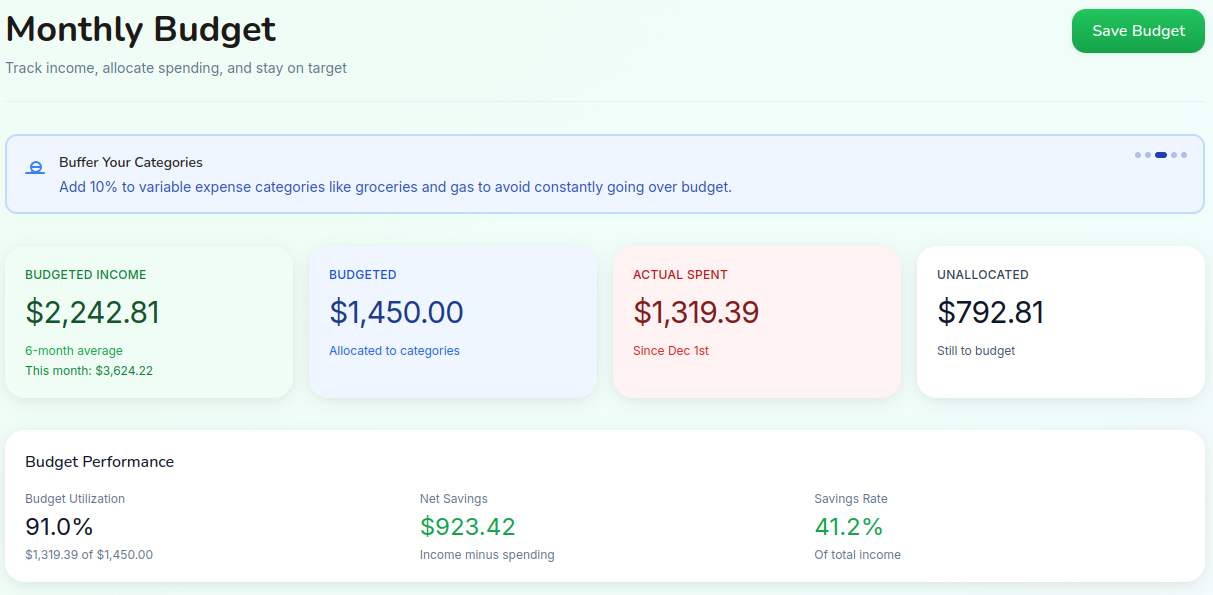

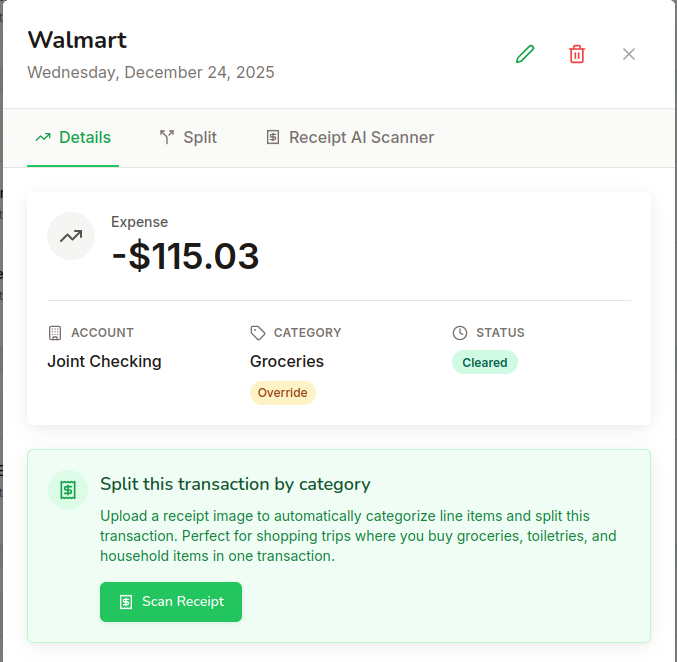

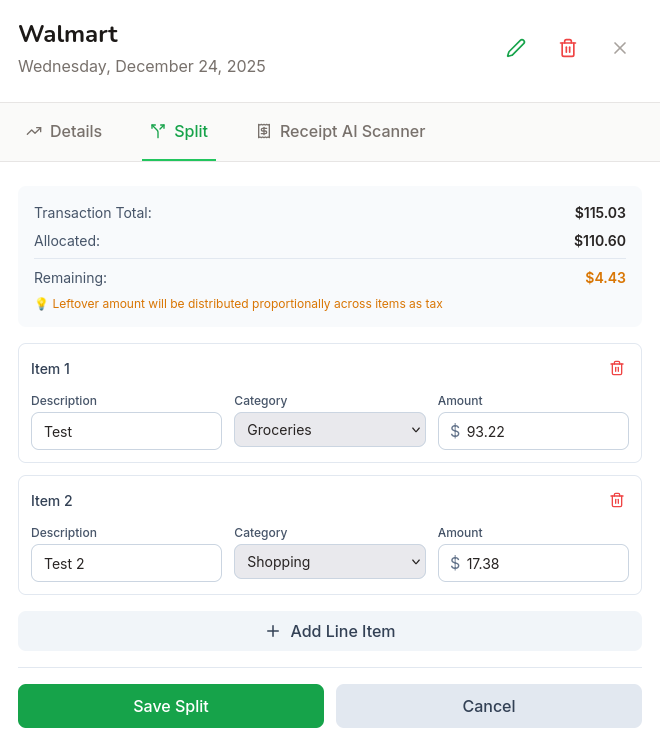

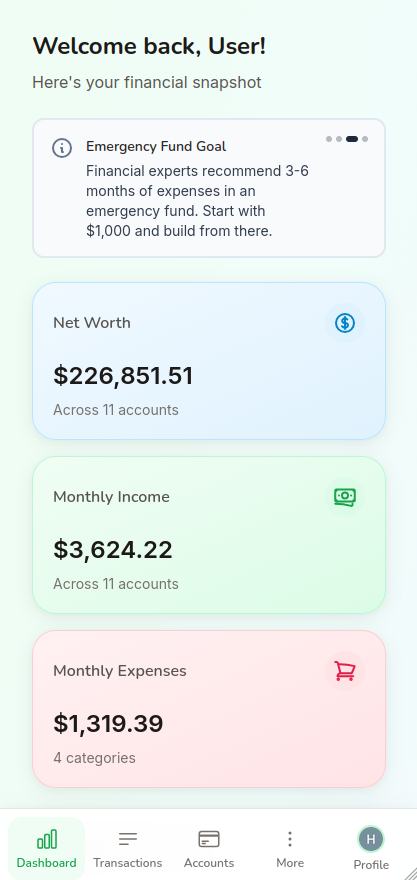

Personal Finance App Built for Real Life

Financial Planning Tool

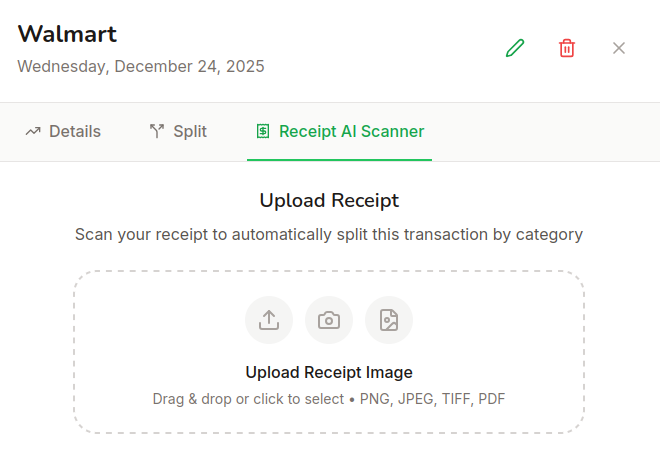

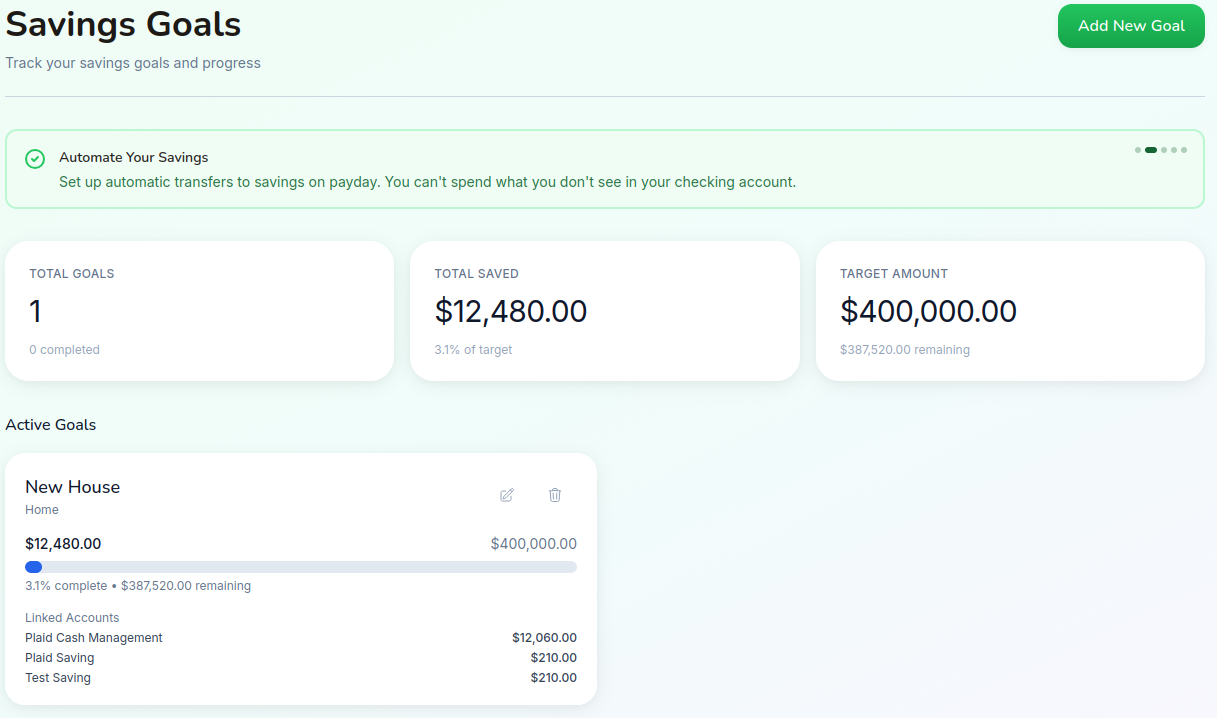

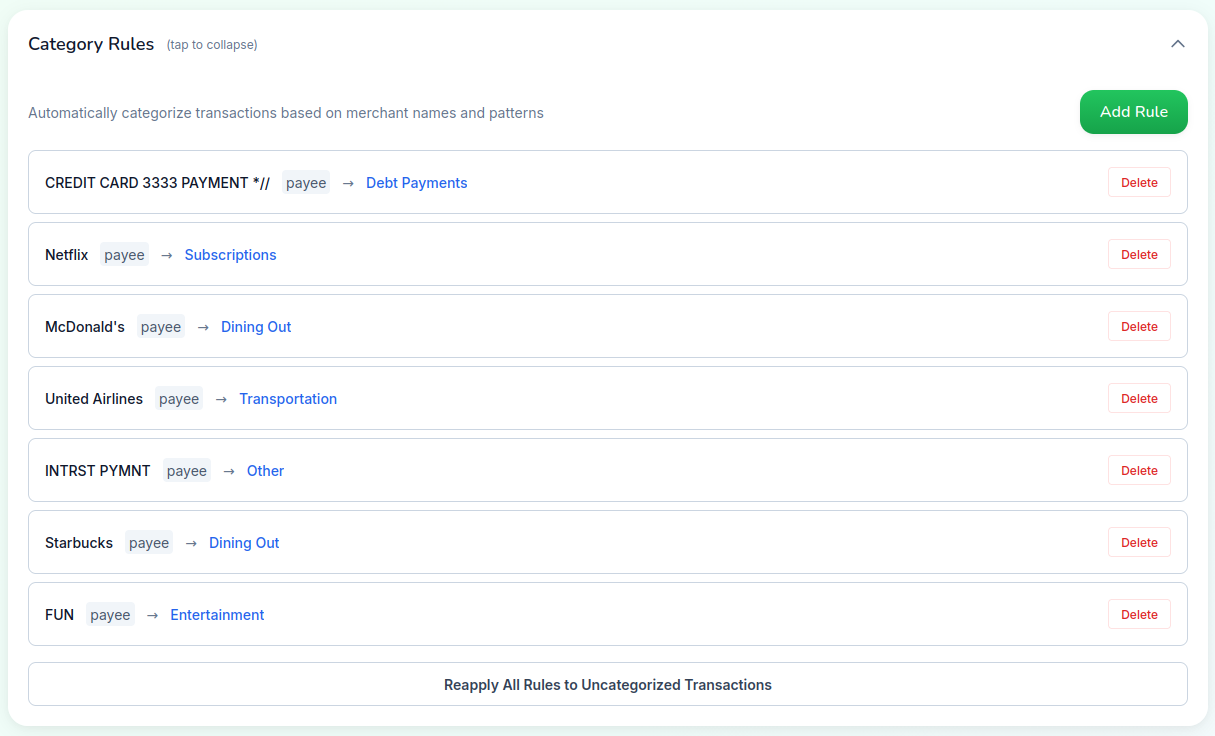

Our budgeting software and personal finance app is built for real life. Track expenses, manage debt, and achieve your financial goals. Built for anyone who wants to take control of their finances and build a secure future.